Saving money is always a hot topic. Everyone loves to find ways to cut costs and keep more cash in their pockets. But not all “money-saving” tactics are created equal. Some of them can end up draining your wallet faster than you think. From the allure of extreme couponing to those irresistible deals on cheap products, it’s easy to fall into these traps. Hint: They often promise savings but deliver headaches instead.

Extreme Couponing Time Trap

Extreme couponing can seem like a savvy way to save big bucks. It’s tempting to dive into the world of clipping, stacking, and strategizing for maximum discounts. But have you considered the time investment? Hours spent gathering coupons, organizing them, and planning trips can easily eat up your free time.

What starts as an exciting hunt often turns into a chore that consumes your weekends. Then there’s the risk of buying items you don’t need just because they’re on sale. That “free” product might end up costing you more in wasted space or expired goods than it saves at checkout. Sometimes simplicity is better when it comes to managing your finances effectively.

Buying Cheap That Breaks Fast

We’ve all been tempted by the allure of a bargain. A low price can be hard to resist, especially when it seems like you’re getting a steal. But cheap items often come with hidden costs. Low-quality products break down quickly, leading to more frequent replacements. That initial savings vanishes fast.

Consider appliances or electronics bought solely for their low price tags. If they fail after just a few months, you’ll find yourself spending even more on repairs or new purchases. Quality matters in the long run, and investing in reliable products pays off. Not only do they last longer but they also save you time and hassle. When shopping, think beyond the sticker price.

Skipping Important Maintenance

Ignoring regular maintenance can seem like a quick way to save money. After all, those routine check-ups and repairs feel unnecessary—until they aren’t. Consider your car. Skipping oil changes or neglecting tire rotations might save you a few bucks now, but it can lead to engine troubles down the line. That small investment in upkeep is often far cheaper than major repairs.

Home maintenance follows the same pattern. Overlooking leaky faucets may not seem urgent at first. But let that drip turn into water damage, and you’ll find yourself facing costly renovations. Even personal health falls victim to this trap. Missing annual check-ups might feel like a good move financially until an untreated issue escalates into something serious.

Over-Insuring Small Risks

Many people think that insurance is a safety net for every little risk. They often buy policies for the smallest issues, believing they’re being smart with their money. But this can backfire. Consider insuring your phone against accidental damage. It might cost you more than simply paying for repairs or replacement out of pocket.

The premiums add up quickly, and if you only make one claim in three years, you’re still at a loss. Then there’s the tendency to insure items like jewelry or electronics. While it seems wise, these small risks can lead to wasted cash over time. Instead of feeling secure, you may end up financially strained.

Smart financial decisions require looking beyond surface-level savings. By avoiding these seemingly clever tips, you can protect your wallet from unnecessary strain and ensure that your hard-earned money is working effectively for you instead of against you. Prioritize quality investments and thoughtful planning; they will yield far better returns than quick fixes or superficial hacks ever could.…

This strategy game lets you build an empire by leading one of eight civilizations through history. You’ll manage your population, develop technologies, and fight enemies in epic battles. The game also features a competitive multiplayer mode that will keep you returning for more.

This strategy game lets you build an empire by leading one of eight civilizations through history. You’ll manage your population, develop technologies, and fight enemies in epic battles. The game also features a competitive multiplayer mode that will keep you returning for more.

A game room can save you money in the long run. How? Well, by having a game room at home, you will have a place to entertain your friends and family without having to spend money on going out to eat or paying for entertainment venues. Additionally, if you have children, a game room can be a great way to keep them entertained without having to spend a lot of money. A game room can include games, movies, and other forms of entertainment that are affordable for any family.

A game room can save you money in the long run. How? Well, by having a game room at home, you will have a place to entertain your friends and family without having to spend money on going out to eat or paying for entertainment venues. Additionally, if you have children, a game room can be a great way to keep them entertained without having to spend a lot of money. A game room can include games, movies, and other forms of entertainment that are affordable for any family. If you are looking for a place to entertain your friends and family, a game room is a perfect solution. A game room can include

If you are looking for a place to entertain your friends and family, a game room is a perfect solution. A game room can include

You must know that you rent a photo booth by the hour. If you miscalculate the duration of your party, you can end up with unnecessary fees for the rental service. On average, the price will be around $200 – $300 per hour with the minimum rent time of three hours. If your event lasts for 12 hours, then you have to be ready to spend at least $3,600 on photo booth rental only.

You must know that you rent a photo booth by the hour. If you miscalculate the duration of your party, you can end up with unnecessary fees for the rental service. On average, the price will be around $200 – $300 per hour with the minimum rent time of three hours. If your event lasts for 12 hours, then you have to be ready to spend at least $3,600 on photo booth rental only.

Hugh Jackman maintained his role as the Wolverine in the X-Men universe for seventeen years. And although at the end of the series he portrayed the old Logan, he still kept his image as a ripped savage. But that achievement was not without hard work. And you need to know that Jackman played Wolverine at age 30s and 40s. It proves how age is just a number.

Hugh Jackman maintained his role as the Wolverine in the X-Men universe for seventeen years. And although at the end of the series he portrayed the old Logan, he still kept his image as a ripped savage. But that achievement was not without hard work. And you need to know that Jackman played Wolverine at age 30s and 40s. It proves how age is just a number. If you know McAvoy from the X-Men universe, then you probably saw nothing extraordinary about his shape. In fact, he always to seemed to play skinny characters. Young Professor X, Wesley Gibson (from Wanted, 2008), are all roles with an ordinary body build.

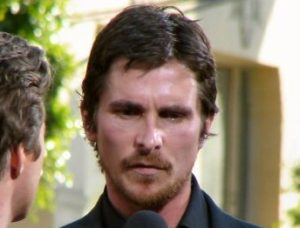

If you know McAvoy from the X-Men universe, then you probably saw nothing extraordinary about his shape. In fact, he always to seemed to play skinny characters. Young Professor X, Wesley Gibson (from Wanted, 2008), are all roles with an ordinary body build. If there was an award for extreme body transformation, Bale should have won it. In The Machinist (2004), Bale played an anorexic factory worker. He took the role seriously and went on an extreme diet to make himself look like a real anorexic person. His weight in The Machinist was 120 pounds.

If there was an award for extreme body transformation, Bale should have won it. In The Machinist (2004), Bale played an anorexic factory worker. He took the role seriously and went on an extreme diet to make himself look like a real anorexic person. His weight in The Machinist was 120 pounds.

When it comes to cinephilia, we have to open our minds to the necessity of SFX (special effects). If you think that

When it comes to cinephilia, we have to open our minds to the necessity of SFX (special effects). If you think that  Alien set a new standard on horror sci-fi industry. It did not terrify the viewers with the typical representation of aliens, which depicted aliens possessing advanced technology, and were using humans as their experiment objects. Instead, Alien brought to us the Xenomorphs, a hunter species that existed solely for killing. Their intention was purely predatory. And to them, humans were nothing but prey.

Alien set a new standard on horror sci-fi industry. It did not terrify the viewers with the typical representation of aliens, which depicted aliens possessing advanced technology, and were using humans as their experiment objects. Instead, Alien brought to us the Xenomorphs, a hunter species that existed solely for killing. Their intention was purely predatory. And to them, humans were nothing but prey.